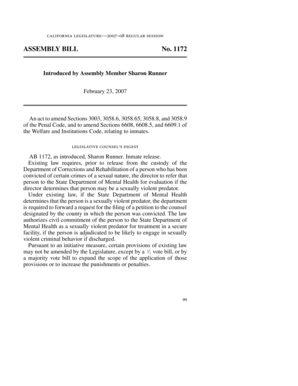

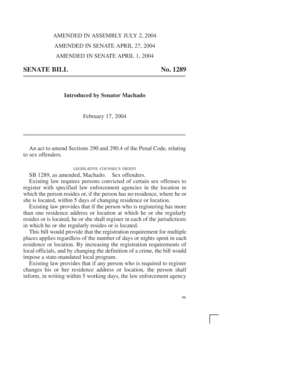

DoL OWCP-20 2012-2025 free printable template

Show details

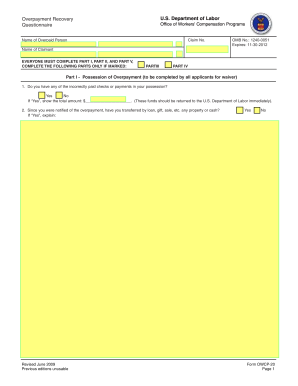

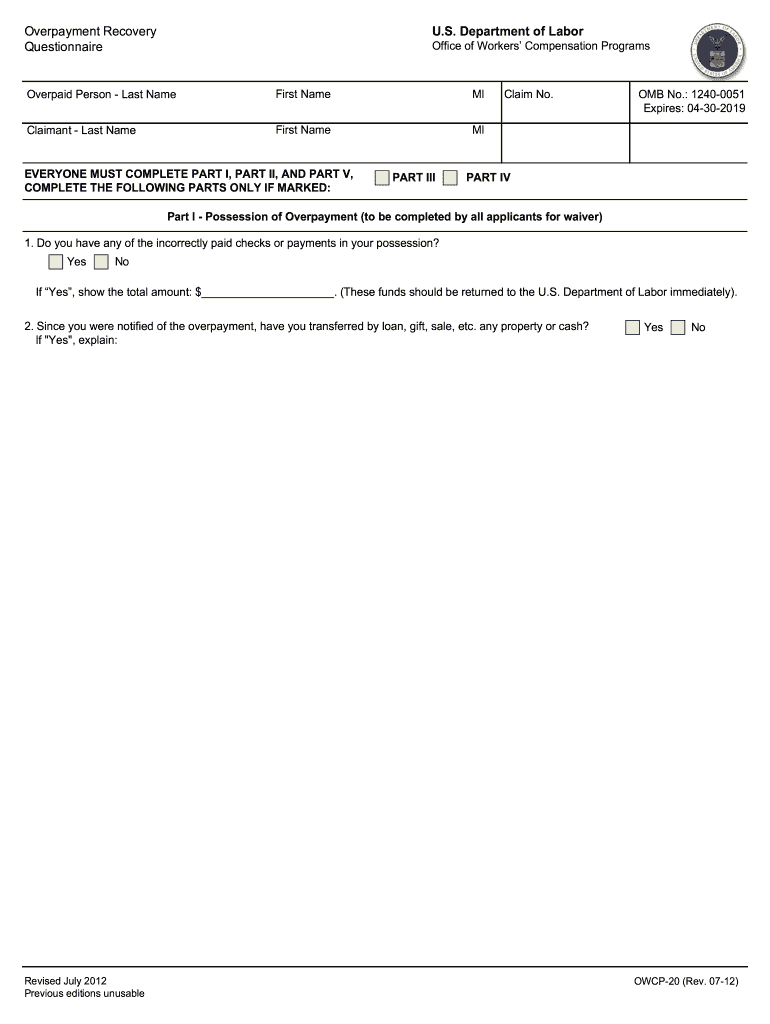

Other Debts Being Paid By Monthly Installments Creditor Amount Owed Total Monthly Expenses OWCP-20 Page 2 Rev. 07-12 6. These funds should be returned to the U.S. Department of Labor immediately. 2. Since you were notified of the overpayment have you transferred by loan gift sale etc. any property or cash If Yes explain Revised July 2012 Previous editions unusable OWCP-20 Rev. 07-12 Part II - REFUND QUESTIONNAIRE To be completed by the person for whom repayment of the overpayment would cause...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign travel visa australia form

Edit your download form 48r tourist visa australia form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your australian tourist visa 48r form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for general tourists to visit australia for tourism online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 48r for tourist visa to australia. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

DoL OWCP-20 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 48s

How to fill out DoL OWCP-20

01

Gather necessary information such as personal details and employment history.

02

Fill out Section 1: Claimant's information including name, address, and contact details.

03

Complete Section 2: Employment information including job title, duty location, and supervisor's name.

04

Fill Section 3: Describe the injury or illness in detail, including date of occurrence.

05

Provide any medical treatment information in Section 4, including names of healthcare providers.

06

Go to Section 5: Provide signature and date to complete the form.

Who needs DoL OWCP-20?

01

Any employee who has sustained an injury or illness related to their federal employment.

02

Individuals seeking workers' compensation benefits under the Federal Employees' Compensation Act (FECA).

Fill

form 48 australia

: Try Risk Free

People Also Ask about mium form 48r for australian tourist visa

Is it better to retire or go on disability?

In most cases, it is better to receive disability benefits until you reach full retirement age. If you collect early retirement, your benefits are permanently reduced. If you receive SSDI payments until you reach full retirement age, there is no permanent reduction in your retirement benefits.

Can I retire on OWCP?

Q: Can I file for Federal Disability Retirement benefits while I am on OWCP Federal Workers' Compensation? A: Yes, you are able to apply for Federal Disability Retirement if you are on OWCP Workers' Compensation but keep in mind that if you are approved, you will not be able to receive both benefits at the same time.

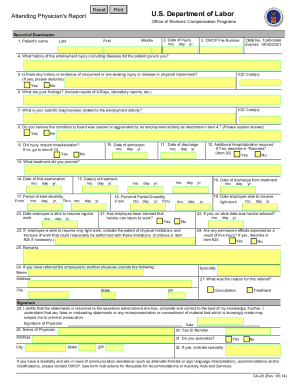

What is the form CA 20 for?

CA-20 Form, Attending Physician's Report - This medical report is required by OWCP BEFORE payment of compensation for loss of wages can be made to the employee.

What is recurrence of OWCP?

A spontaneous return of the same signs and symptoms you experienced when you sustained your first injury. You must experience an increase or return of disability as a result of a consequential injury which is an injury caused by the impairment or weakness from your original injury.

What is the retirement age for Owcp?

A: You can stay on the disability retirement benefit until age 62, once you reach 62 years old the benefit will automatically switch to regular retirement.

What is a CA 1032 form?

Form CA-1032 is issued to all claimants on the periodic roll on an annual basis. This information is used to decide whether the claimant is entitled to continue receiving compensation benefits, or whether his/her benefits should be adjusted.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send application visit 48r for eSignature?

australia tourism 48r pdf is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for the australia visitor form 48r in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your visa 48r tourist in minutes.

Can I create an eSignature for the australia tourism 48r get in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your australian tourist visa form 48r india and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is DoL OWCP-20?

DoL OWCP-20 is a form used by the U.S. Department of Labor's Office of Workers' Compensation Programs (OWCP) to report the details of work-related injuries or illnesses.

Who is required to file DoL OWCP-20?

Employers and insurance carriers are required to file DoL OWCP-20 for employees who have sustained work-related injuries or illnesses that require compensation or benefits.

How to fill out DoL OWCP-20?

To fill out DoL OWCP-20, provide accurate details about the injured employee, the nature of the injury or illness, the circumstances surrounding the incident, and any medical treatment provided.

What is the purpose of DoL OWCP-20?

The purpose of DoL OWCP-20 is to document work-related injuries or illnesses, which aids in the processing of workers' compensation claims and ensures that the affected employees receive appropriate benefits.

What information must be reported on DoL OWCP-20?

The information that must be reported on DoL OWCP-20 includes the employee's name, date of birth, social security number, date of injury, type of injury, medical treatment received, and witness information if applicable.

Fill out your DoL OWCP-20 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 48r Australia is not the form you're looking for?Search for another form here.

Keywords relevant to visa 48r australia

Related to australia tourist visa form 48r

If you believe that this page should be taken down, please follow our DMCA take down process

here

.